Piper Jaffray Completes Semi-Annual Generation Z Survey of 8,600 U.S. Teens

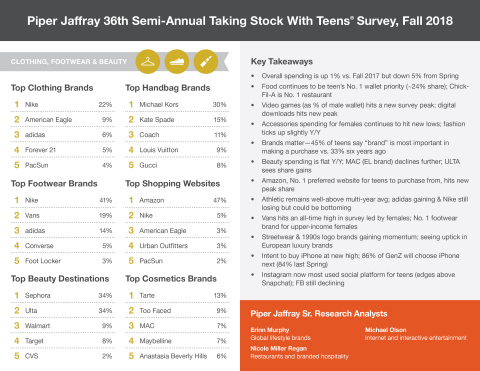

- Overall teen spending down 5% from spring and up 1% from a year ago

- Food and video games continue to dominate teen wallet

- Accessories share of female wallets reached an all-time low (under 5%)

- Instagram surpasses Snapchat as the

No. 1 most used social media platform asFacebook engagement declines

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181022005679/en/

For an infographic, podcasts and more information regarding the most recent survey, visit piperjaffray.com/teens.

“Our fall survey showed overall teen spending as flat with the prior year. That said, teen spending continues to expand in categories like video games & food. Females now indicate they spend 3x more on beauty than accessories,” said

Fall 2018 Key Findings

Spending & Shopping Behavior

- Food continues to be teens’

No. 1 spending category, remaining at its 24% peak Chick-fil-A isNo. 1 restaurant, followed byStarbucks - Male spending on video games reaches a new peak at 14%

- Most notable brand gainers have been Vans,

Adidas , lululemon and surprisingly,Crocs - Rotation of female spending out of fashion accessories and into personal care

- Teens overwhelmingly prefer to shop for color cosmetics in-store (91% of female teens) vs. online

Brand Preferences

- Brands matter – 45% of teens say “brand” is most important in making a purchase vs. 33% (six years ago)

- 1990s and streetwear styles continue to grow with

Tommy Hilfiger , Supreme, CK and Champion – and even luxury brands including Off-White, Balenciaga and Gucci Nike mindshare declines from 25% to 22%;Adidas remains No. 3 brandAmazon consistently teens’ favorite website - mindshare increases to 47% (44% last spring)- Intent to buy iPhone continues to climb – 86% of Gen-Z will choose the iPhone next (compared to 84% last spring)

The Piper Jaffray Taking Stock With Teens® survey is a semi-annual research project that gathers input from approximately 8,600 teens with an average age of 16 years. Discretionary spending patterns, fashion trends, technology, and brand and media preferences are assessed through surveying a geographically diverse subset of high schools across the U.S. Since the project began in 2001,

* Source: Fung Global Retail & Technology

Follow

© 2018

View source version on businesswire.com: https://www.businesswire.com/news/home/20181022005679/en/

Source:

Piper Jaffray Companies

Pamela Steensland, 612-303-8185

analystmediarelations@pjc.com